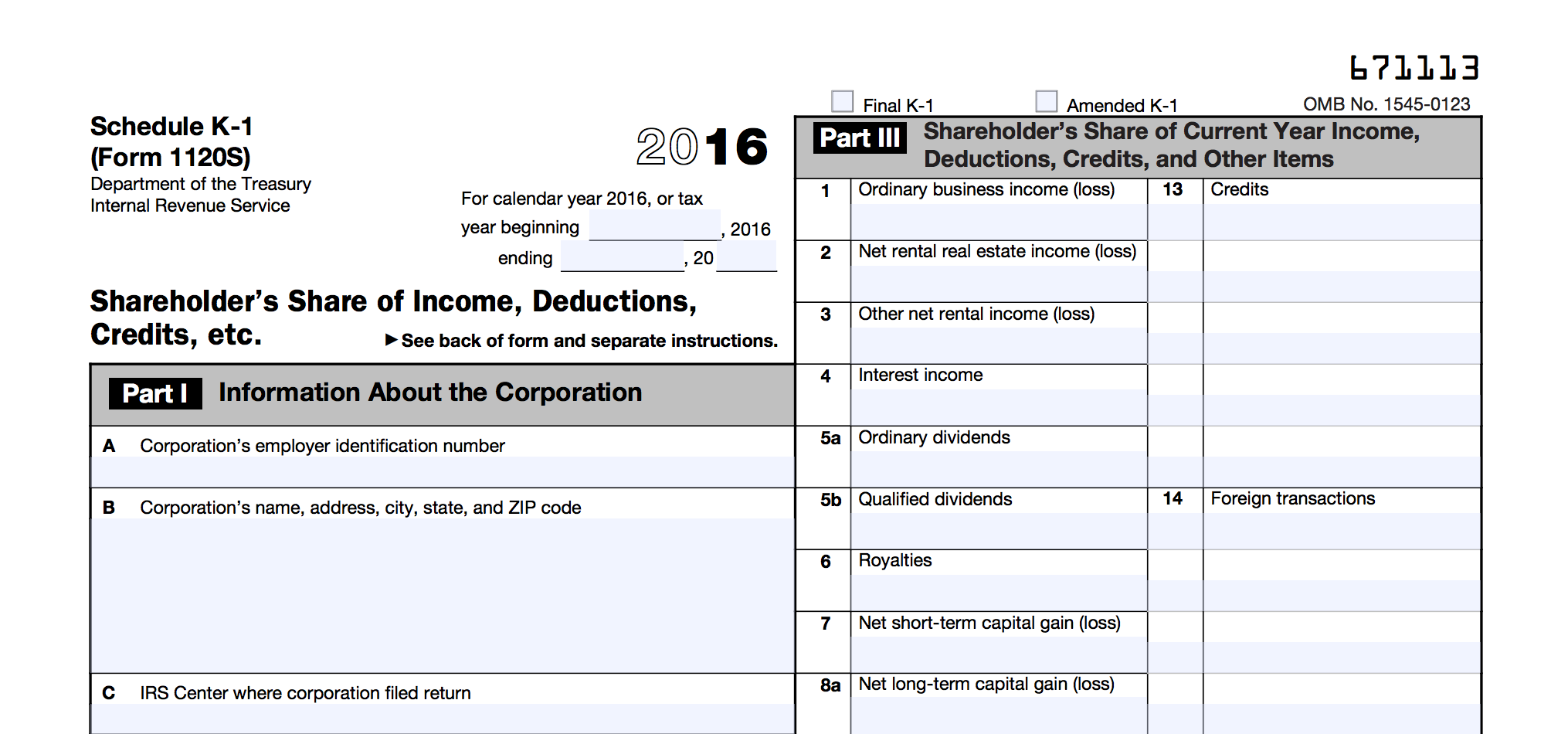

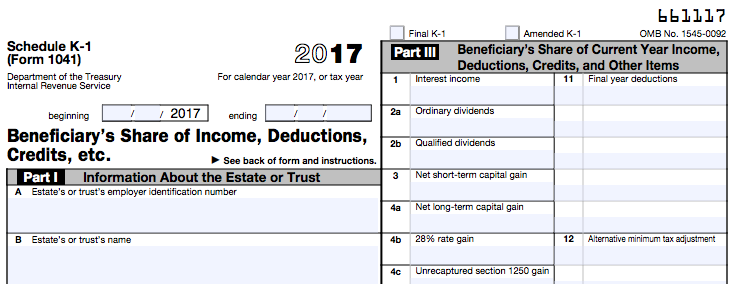

The partner may need to pay tax on their share of the partnership income by reporting it on their individual tax return. It is not filed with a partner’s tax return, unless the IRS requires you to do so. The business must be a partnership business structure. What Is a Schedule K-1 Tax Form?Ī Schedule K-1 Tax Form is used to report a partner’s share of a business’s income, credits, deductions etc. If you need income tax advice please contact an accountant in your area. NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks.

Each partner files a copy of this schedule with the Internal Revenue Service (IRS). A partnership business structure has at least two partners. A Schedule K-1 (Form 1065) tax form reports on a partner’s share of the income, deductions, credits and more of their business.

0 kommentar(er)

0 kommentar(er)